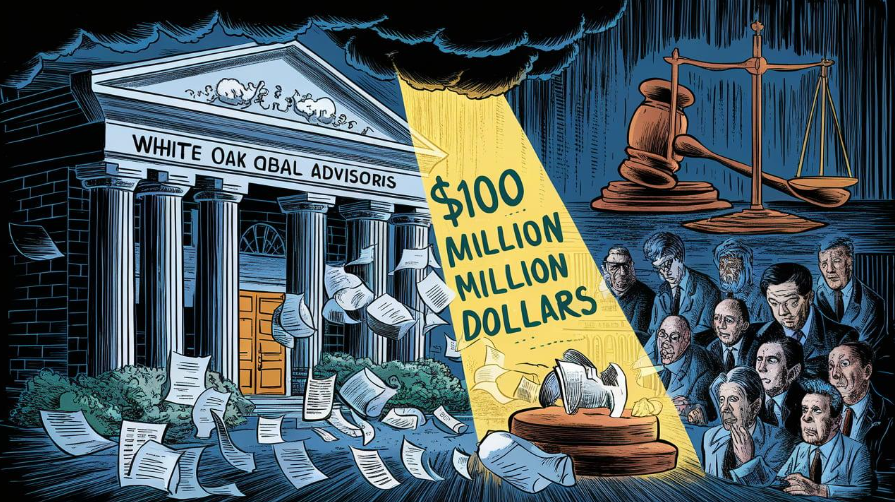

White Oak Global Advisors Lawsuit has been involved in litigation that could potentially have major consequences for its company. White Oak was accused by a New York client of failing to provide pension benefits worth more than 100 millions dollars. As a result, this case raised many questions in both financial and healthcare industries.

White Oak Global Advisors Lawsuit

White Oak Global Advisors Lawsuit enjoys a reputation for being a leader in direct lending as well as private lending. It is an established leader of the financial industry and has a reputation for offering clients tailored services. Recent lawsuits have a negative impact on this company’s image. They raise concerns regarding the handling of funds invested by customers.

This Allegation

White Oak Global Advisors Lawsuit is being sued for the mismanagement New York Nurses’ pension fund. Plaintiffs state that they did not perform their financial obligations resulting in over $100 million of losses. This deficit is serious for nurses because they depend on their retirement pensions.

New York Nurses

Courts have been made aware of a significant issue facing New York’s nursing community. One of the main sources of income that retirees have is pension funds. You should be aware that mismanagement of the funds could lead to serious problems for your organization. Several reports indicate that financial instability is a problem for nurses. This instability has led to many expressing concern over their prospects in the future.

Legal Procedure

A long and complicated legal process is to be expected. White Oak Global Advisors Lawsuit strongly defended against the allegations, asserting that the lawsuit has no merit. White Oak Global Advisors Lawsuit has a similar view, but the plaintiffs are also seeking accountability for what is perceived to be a violation in fiduciary duties.

What is the core of disagreement?

- White Oak Global Advisors was the target of several lawsuits claiming that it mismanaged pension fund and had caused substantial financial losses to its shareholder.

- Fiduciary Duty Breach. According to this lawsuit, the law firm didn’t fulfill their fiduciary duties by handling the funds with the maximum caution.

- There is a concern raised that the impact of this change on nurses will be detrimental to their ability to support themselves and their families.

White Oak Global Advisors’ Response

White Oak Global Advisors Lawsuit firmly denied the allegations in response to this lawsuit. The company claims that it has always worked in its client’s best interest and believes that the lawsuit was unfounded. The company said that it was confident of its ability to succeed in court.

Additional Implications

It has wider implications than just the immediate impact on finances. The case brings up questions concerning the supervision and regulation of retirement funds as well the responsibilities and responsibilities of the financial managers. This case could be a benchmark for the way similar cases will be handled in future.

Financial Sector Reaction

The Financial sector closely monitors the White Oak Global advisors lawsuit. Debattations are taking place among industry professionals about the likely outcomes of this lawsuit and its impact on market. The case has divided opinion. While some believe it could result in stricter regulations for pension fund managers and more scrutiny, others think that this is a good reminder to the dangers of financial investments.

Public and Media Respondent

Media and the general public have responded strongly to white oak’s global advisors suit. A growing number of people are indignant at the mismanagement of pension funds, and they want greater accountability from the financial sector. A number of news outlets have covered this story extensively to bring it to a broader audience.

You Can Move Forward

While the lawsuit against white oak advisors progresses it is vital to keep a close eye on developments. The case outcome may have far reaching consequences for financial institutions and thousands of nurses impacted by the alleged mismanagement.

Conclusion

It is important to note that the lawsuit brought against White Oak Global Advisors Lawsuit by New York nurses over $100 million pensions has potential implications for the future. This lawsuit underscores fiduciary accountability and the need to have strict financial oversight. This case, as it unfolds will probably serve to be the key reference point of future discussions regarding pension fund and financial management.

FAQs

What’s the case against white oak Global Advisors?

White Oak Global Advisors was sued by New York nurses for over $100 million in compensation.

Which plaintiffs have filed a lawsuit against white oak global advisers?

White Oak Global Advisors allegedly mismanaged the pensions for a New York group of nurses.

What are White Oak Global Advisors’ main charges?

There are two main allegations: financial mismanagement and breach in fiduciary obligation, which led to an important shortfall within the pension funds.

How has White Oak Global Advisors reacted to the lawsuit filed?

White Oak Global Advisors have denied all allegations. The company has stated the lawsuit to be baseless, and expressed their confidence in their own defense.

What would be the implications for the wider community of the White oak Global Advisors case?

The case might lead to tighter rules and a greater oversight in the management of pensions funds, as well as serve a precedent that could apply to similar future situations.

Why does white oak Global Advisors’ lawsuit matter?

There are implications for thousands of New Yorkers nurses as well the entire financial industry.